A Quick Guide on Payroll Processing Outsourcing

Running a business may seem pretty simple: developing a product or service strategy, marketing to prospective customers, and making profits from sales. But between managing core operations such as manufacturing, product/service delivery, financial analysis and non-core functions including human resources, logistics, and payroll processing, it can never be a smooth ride from point A to point B.

While considered a non-core business activity, payroll processing is crucial for the success of a company. Many organizations make the mistake of assuming that this should be done in house. Though this can be the right decision for others, most businesses quickly realize that this can be time-consuming, costly, and risky in more ways than they imagined.

Outsourcing payroll processing enables organizations to improve administration, optimize productivity, and focus resources on core business functions. Regardless of size, nature, or industry, outsourcing payroll processing is an attractive and wise investment for any business.

Payroll Outsourcing Services

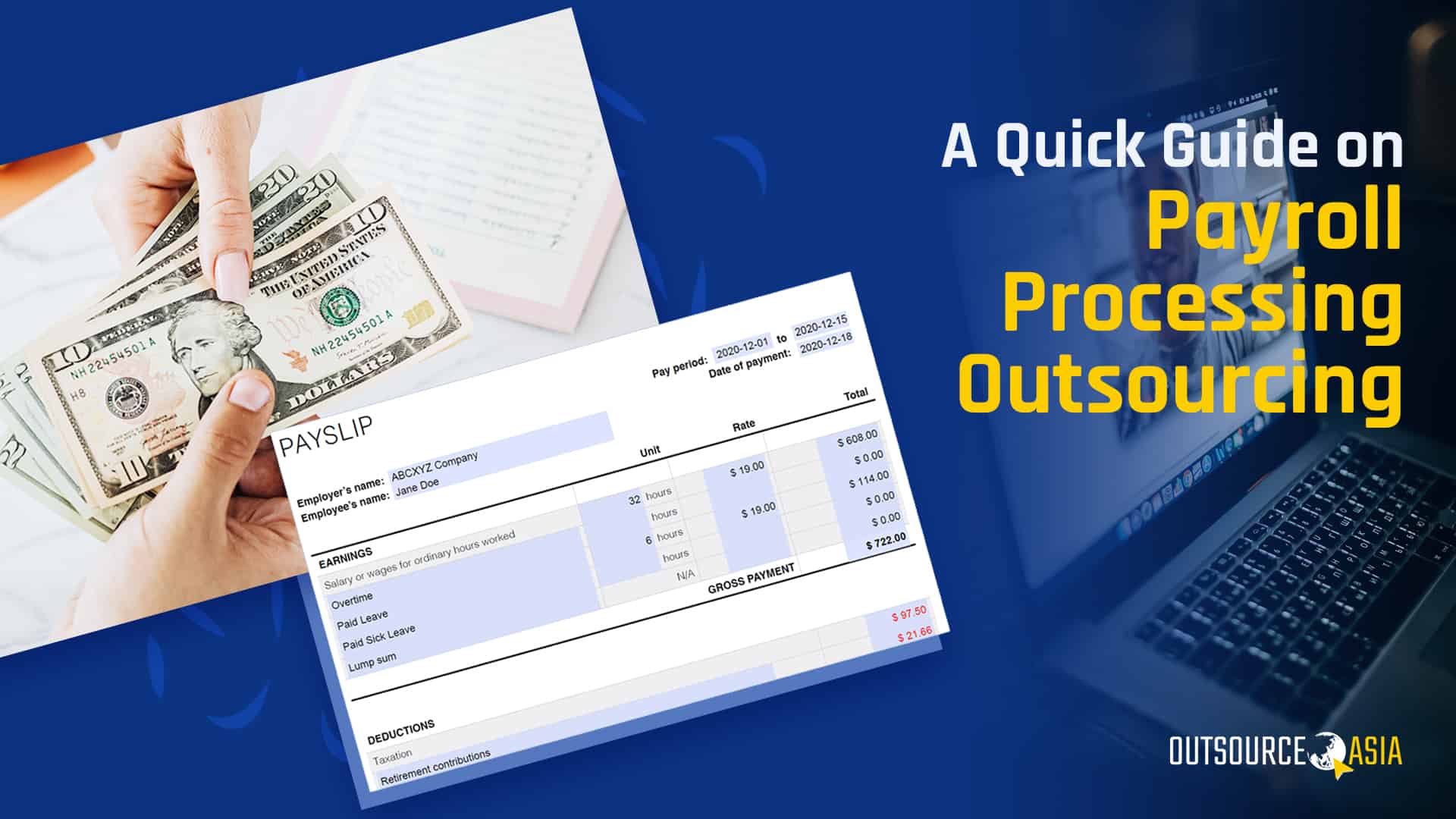

Payroll processing refers to the task of managing the wages of employees per pay period based on employee type, status, and compensation. It involves calculating total earnings, withholding deductions, paying mandatory benefits, and filing payroll taxes.

Through a reliable payroll outsourcing service provider, companies can have the confidence that there is quality, efficiency, and accuracy in managing and completing payroll processes.

Payroll outsourcing services include:

- Calculation of wages and salaries for both in-house and outsourced employees

- Computation of withholding income taxes

- Computation and allocation of government-mandated employee contributions across multiple agencies

- Transfer of funds, printing of checks, and execution of bank deposits (as needed)

- Preparation and delivery of management reports

- Software as Service (SaaS)

- In-House Deployment

- Payroll as a Service

Advantages of Outsourcing Payroll Processing

First, the availability of cloud-based systems guarantees speed, accessibility, and security. For this reason, the global market for payroll processing solutions expects a 4.4% CAGR (compound annual growth rate) through 2023.

Second, outsourcing payroll processing to a specialist partner can help reduce expenses by at least 20% as there is no longer a need to hire full-time staff and purchase equipment for payroll management.

Third, there is instant access to experts in everything related to paying employees, taxes, and government compliance.

Disadvantages of Outsourcing Payroll Processing

There are also challenges when payroll processing is not done in house. First, the wrong service provider can still make mistakes which can cause security risks or legal issues. Second, it cannot be avoided to share confidential and sensitive information.

Why Turn to Payroll Processing Outsourcing

Outsourcing in the Philippines accounts for 10-15% of the global BPO industry. The Philippine outsourcing scene offers IT services, finance services, HR solutions, and HR administrative services including payroll processing.

Payroll service providers can offer solutions depending on a business’ payroll process which may vary in terms of complexity or the company’s size. Several factors affect the implementation of payroll solutions including:

- Technological frameworks and advanced systems

- Taxation and legal framework of the country where the business and its employees are

- Human resource considerations and varied working arrangements

- Documentation requirements

If you are looking to outsource your payroll processing, to learn more about the available solutions, and to find a service partner you can trust, get help from Outsource Asia. Check out our free resources and growing directory of the outsource partners, or simply send us a message.